State pension age, a pivotal milestone in individuals’ lives, has been a subject of ongoing debate and policy considerations. This article delves into the intricacies of state pension age, exploring its significance, historical evolution, and the myriad factors that influence its determination.

As we age, the prospect of retirement and the availability of state pension benefits become increasingly important. Understanding the complexities of state pension age is crucial for effective retirement planning and ensuring financial security in our later years.

Overview of State Pension Age

The state pension age is the age at which individuals become eligible to receive a state pension, a regular payment from the government to provide financial support during retirement. It is a crucial concept that significantly impacts individuals’ retirement planning and financial well-being.

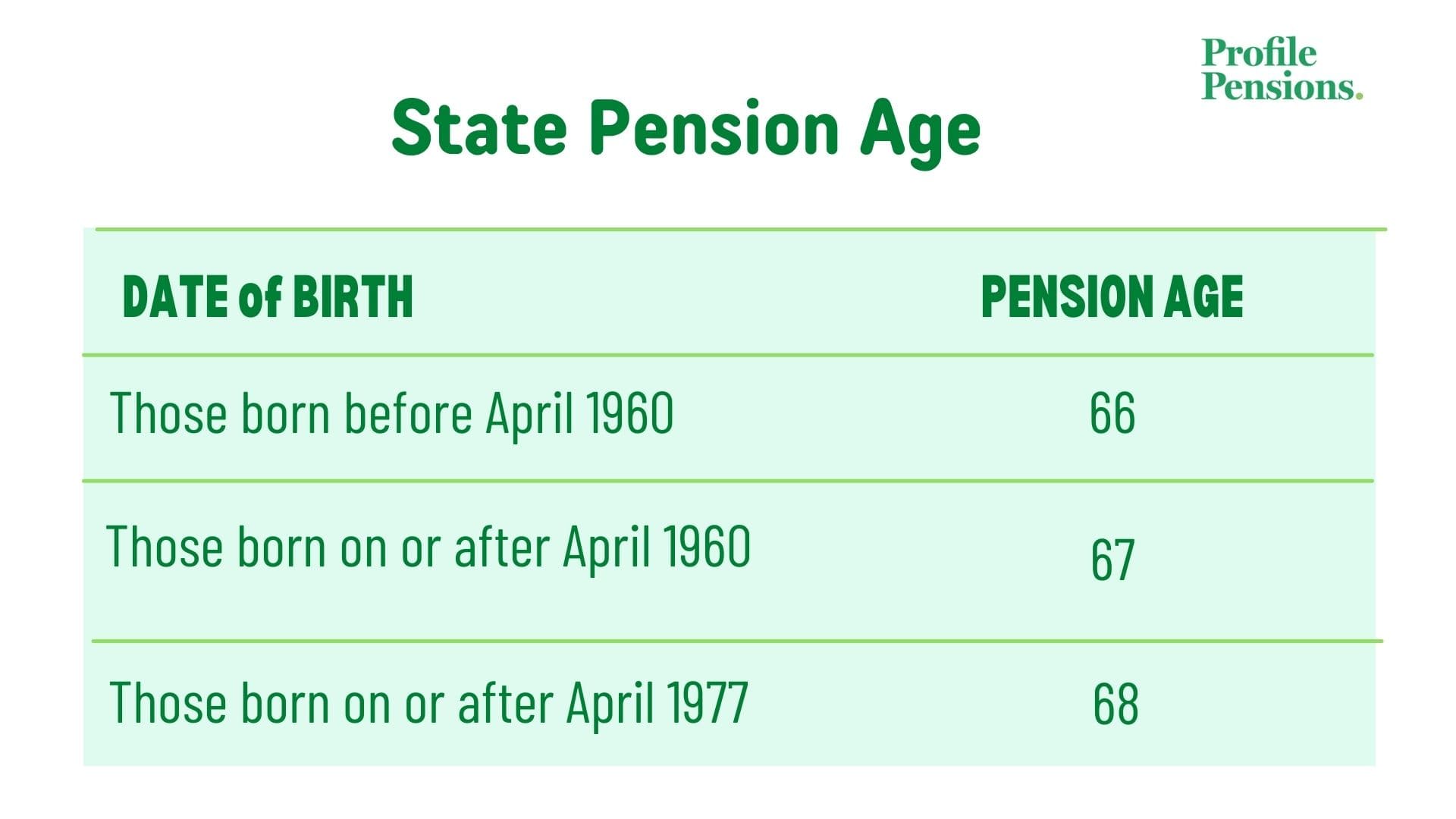

Historically, the state pension age has undergone changes in different countries, influenced by factors such as demographic shifts, economic conditions, and political ideologies. For instance, in the United Kingdom, the state pension age for women was raised from 60 to 65 in 2018, while the age for men is set to increase from 65 to 67 by 2028.

The table below provides a summary of the state pension ages in major countries, including the current age, projected changes, and the rationale for these changes:

| Country | Current Age | Projected Changes | Rationale |

|---|---|---|---|

| United Kingdom | 66 (men), 65 (women) | 67 (men), 66 (women) by 2028 | To ensure the sustainability of the pension system and address increasing life expectancy. |

| United States | 66 (full retirement age) | 67 (full retirement age) by 2027 | To address the increasing cost of providing social security benefits and the longer life expectancy of retirees. |

| Germany | 65 (men and women) | 67 (men and women) by 2031 | To ensure the financial stability of the pension system and account for the increasing life expectancy of Germans. |

| France | 62 (men and women) | 64 (men and women) by 2030 | To address the financial challenges faced by the pension system and encourage people to work longer. |

| Japan | 65 (men and women) | 68 (men and women) by 2025 | To address the rapidly aging population and ensure the sustainability of the pension system. |

The evolution of state pension age has been influenced by various political and economic factors. Governments have had to balance the need to provide adequate retirement income for their citizens with the financial sustainability of pension systems. Economic conditions, such as rising healthcare costs and low interest rates, have also played a role in shaping the state pension age.

Factors Influencing State Pension Age

The determination of state pension age is influenced by a complex interplay of demographic, economic, and social factors. These factors can vary significantly across countries, leading to different approaches to setting and adjusting state pension ages.

Demographic Factors

- Life Expectancy: Increasing life expectancy has a profound impact on state pension age decisions. As people live longer, the period over which they receive pension benefits increases, putting pressure on pension systems.

- Ageing Population: The ageing of the population, characterized by a growing proportion of older adults, can also influence state pension age. A larger proportion of retirees relative to the working population can strain pension systems, potentially leading to adjustments in pension age.

Economic Factors

- Labor Market Participation: The participation of older adults in the labor force can influence state pension age. If older adults continue to work longer, it may be possible to delay the age at which they start receiving pension benefits.

- Retirement Patterns: Changing retirement patterns, such as the trend towards earlier retirement, can also impact state pension age. If people retire earlier, it can put pressure on pension systems, potentially leading to increases in pension age.

- Economic Growth: The overall economic growth of a country can influence state pension age decisions. Strong economic growth can provide additional resources to support pension systems, potentially allowing for lower pension ages.

Social Factors

- Intergenerational Equity: The concept of intergenerational equity suggests that the burden of supporting the elderly should be shared fairly across generations. This can influence decisions about state pension age, balancing the interests of current retirees with those of future generations.

- Health and Well-being: The health and well-being of older adults can also play a role in determining state pension age. If older adults are healthier and more active, they may be able to continue working longer, potentially delaying the need to adjust pension age.

- Cultural Norms: Cultural norms and values can influence attitudes towards retirement and the role of older adults in society. These norms can shape public opinion and policy decisions related to state pension age.

The relative importance of these factors can vary depending on the specific context and circumstances of each country. Policymakers must carefully consider these factors when making decisions about state pension age, balancing the need for sustainability with the well-being of current and future generations.

Summary of Key Factors

| Factor | Impact on State Pension Age |

|---|---|

| Life Expectancy | Increases in life expectancy lead to higher state pension ages. |

| Ageing Population | A larger proportion of older adults can strain pension systems, potentially leading to increases in state pension age. |

| Labor Market Participation | Increased labor market participation of older adults can delay the need for adjustments in state pension age. |

| Retirement Patterns | Earlier retirement patterns can put pressure on pension systems, potentially leading to increases in state pension age. |

| Economic Growth | Strong economic growth can provide additional resources to support pension systems, potentially allowing for lower state pension ages. |

| Intergenerational Equity | The concept of intergenerational equity can influence decisions about state pension age, balancing the interests of current retirees with those of future generations. |

| Health and Well-being | Improved health and well-being of older adults can delay the need for adjustments in state pension age. |

| Cultural Norms | Cultural norms and values can influence attitudes towards retirement and the role of older adults in society, shaping policy decisions related to state pension age. |

Examples from Different Countries

- In Japan, the state pension age was raised from 60 to 65 in 2013 due to increasing life expectancy and a rapidly ageing population.

- In Sweden, the state pension age is linked to life expectancy and is adjusted automatically as life expectancy increases.

- In the United States, the state pension age for full benefits is 67 for those born in 1960 or later, and it will gradually increase to 69 for those born in 1969 or later.

Methods for Calculating State Pension Age

Calculating state pension age involves a combination of actuarial calculations and political considerations. Actuarial calculations provide a technical assessment of the financial implications of different pension age scenarios, while political considerations reflect the broader social and economic context.

Actuarial calculations typically use demographic data, such as life expectancy and fertility rates, to estimate the long-term costs and benefits of different pension age options. These calculations aim to ensure that the pension system is financially sustainable over the long term. Political considerations, on the other hand, may include factors such as the desired balance between work and retirement, the impact on the labor market, and the overall fairness of the system.

Role of Government Actuaries

Government actuaries play a crucial role in determining state pension age. They provide independent advice to policymakers based on actuarial calculations and analysis. Their expertise helps ensure that pension age decisions are informed by sound financial principles and long-term sustainability considerations.

International Comparisons of State Pension Age

The state pension age varies significantly across countries, influenced by various factors. Here, we present a table comparing state pension ages in different nations and analyze the variations and contributing factors.

Comparative Table of State Pension Ages

| Country | State Pension Age |

|---|---|

| Australia | 67 (to increase to 68) |

| Canada | 65 (to increase to 67) |

| France | 62 |

| Germany | 66 (to increase to 67) |

| Italy | 67 |

| Japan | 65 (to increase to 68) |

| United Kingdom | 66 (to increase to 68) |

| United States | 66 (to increase to 67) |

Variations and Contributing Factors

The table shows a range of state pension ages, from 62 in France to 68 in Japan (to increase). These variations can be attributed to several factors, including:

- Life expectancy: Countries with higher life expectancies tend to have higher state pension ages, as people are expected to live longer and draw on their pensions for a more extended period.

- Economic growth: Strong economic growth can support higher state pension ages, as it allows governments to allocate more resources to pensions while maintaining economic stability.

- Labor market conditions: Labor market shortages or high unemployment rates can influence state pension ages, with governments adjusting them to balance the need for older workers in the labor force with the availability of jobs.

- Social and cultural norms: Cultural norms and values regarding retirement and the role of older people in society can shape state pension ages.

Identify the key policy considerations involved in setting state pension age.

Setting the state pension age involves balancing multiple policy considerations, including:

- Sustainability: Ensuring the long-term financial viability of the pension system to meet future obligations.

- Adequacy: Providing sufficient income to retirees to maintain a reasonable standard of living.

- Equity: Treating all individuals fairly and equitably, regardless of age, gender, or other factors.

Impact of State Pension Age on Individuals

State pension age significantly influences individuals’ retirement plans and financial security. Raising the state pension age affects the age at which people can access their pension benefits, impacting their retirement plans and financial well-being.

Implications for Different Demographic Groups

- Women: Women are disproportionately affected by increasing state pension age, as they typically have lower earnings and shorter working lives than men. Raising the state pension age can exacerbate gender inequality in retirement income and increase the likelihood of poverty among older women.

- Older workers: Raising the state pension age can have a negative impact on older workers, particularly those in physically demanding or low-paid jobs. They may struggle to continue working until the new state pension age, leading to financial hardship and reduced quality of life.

Potential Impact on Poverty and Inequality

Increasing state pension age has the potential to increase poverty and inequality among older adults. Those who are unable to continue working until the new state pension age may face financial hardship and rely on means-tested benefits. This can lead to increased poverty rates and a widening gap between the wealthy and the poor in retirement.

Impact of State Pension Age on Employers

The state pension age significantly impacts employers, influencing their costs, workforce planning, and the availability and age structure of their workforce. Changes in the state pension age can have far-reaching implications for businesses, affecting their competitiveness and overall operations.

Employer Costs and Workforce Planning

An increase in the state pension age means that individuals can continue working for longer, potentially reducing employer pension contributions and other retirement-related expenses. However, it can also lead to increased healthcare and other benefits costs for older workers. Employers may need to adjust their workforce planning to accommodate an aging workforce, including providing flexible work arrangements and training opportunities for older employees.

Availability of Labor and Age Structure of the Workforce

A higher state pension age can affect the availability of labor, particularly in sectors that rely on older workers. Employers may face challenges in recruiting and retaining experienced workers who are eligible to retire. Conversely, a lower state pension age can lead to an influx of younger workers into the labor market, potentially benefiting employers seeking to hire entry-level employees.

Business Competitiveness

Changes in the state pension age can impact business competitiveness. Companies in countries with a higher state pension age may have a competitive advantage in attracting and retaining older workers, who bring valuable experience and expertise. Conversely, countries with a lower state pension age may have a larger pool of younger workers, which can be beneficial for industries requiring a youthful workforce.

Specific Examples

* In the United Kingdom, the gradual increase in the state pension age from 65 to 68 has led to a decline in the number of older workers in the labor force.

* In Germany, the introduction of a flexible state pension age has allowed individuals to choose when they retire, resulting in a more diverse age structure in the workforce.

* In Japan, the government has implemented measures to encourage older workers to remain in the labor force, including providing financial incentives and flexible work arrangements.

Potential Implications of Further Changes

Further changes to the state pension age are likely to have a significant impact on employers. A higher state pension age could lead to labor shortages and increased costs for businesses. A lower state pension age could result in a more youthful workforce and reduced pension contributions.

Recommendations for Employers

Employers can mitigate the impact of state pension age changes by:

* Implementing flexible work arrangements and training opportunities for older workers.

* Revisiting their recruitment and retention strategies to attract and retain older workers.

* Collaborating with government and industry organizations to advocate for policies that support an aging workforce.

Summary of Key Findings

- State pension age affects employer costs, workforce planning, and the availability of labor.

- Changes in state pension age can impact business competitiveness.

- Employers can mitigate the impact of state pension age changes by implementing flexible work arrangements, revisiting their recruitment and retention strategies, and collaborating with stakeholders.

References

* [1] International Labour Organization. (2022). World Social Protection Report 2020-22: Social protection in the informal economy.

* [2] Organisation for Economic Co-operation and Development. (2021). Pensions at a Glance 2021: OECD and G20 Indicators.

Impact of State Pension Age on Government Finances

The state pension age has a significant impact on government finances, both in terms of expenditure and revenue. On the expenditure side, the state pension is one of the largest items of government spending, accounting for a significant proportion of the budget in many countries. As the population ages, the number of people claiming the state pension is increasing, which is putting pressure on government budgets.

Long-term Sustainability of State Pension Systems

The long-term sustainability of state pension systems is a major concern for many governments. As life expectancy increases and fertility rates decline, the ratio of pensioners to workers is increasing. This means that there are fewer people paying into the state pension system and more people claiming benefits, which is making it increasingly difficult to finance the system.

Impact on Public Debt and Economic Growth

The state pension age can also have a significant impact on public debt and economic growth. If the state pension age is increased, it can reduce government spending on pensions, which can lead to a reduction in public debt. However, it can also lead to a reduction in economic growth, as older people are less likely to spend money and invest in the economy.

Impact on Different Demographic Groups

The state pension age can also have a significant impact on different demographic groups. For example, women tend to live longer than men, so they are more likely to claim the state pension for a longer period of time. Ethnic minorities and low-income individuals are also more likely to claim the state pension at a younger age, as they are more likely to have shorter life expectancies and lower incomes.

Policy Interventions

There are a number of policy interventions that governments can use to address the challenges posed by an aging population. These include increasing the retirement age, raising taxes, or reducing benefits. However, each of these options has its own advantages and disadvantages, and there is no easy solution to the problem of financing state pensions.

Identify the key challenges and opportunities in reforming state pension age

Reforming the state pension age is a complex and challenging issue, with a range of potential benefits and risks. Key challenges include the need to ensure the sustainability of the pension system, while also ensuring that individuals have adequate retirement income. Opportunities include the potential to increase labor force participation and reduce the burden on government finances.

Challenges, State pension age

- Ensuring the sustainability of the pension system: The increasing life expectancy and the aging population are putting pressure on the sustainability of the pension system. Reforming the state pension age can help to ensure that the system remains sustainable in the long term.

- Ensuring adequate retirement income: Individuals need to have adequate retirement income to maintain their standard of living in retirement. Reforming the state pension age can help to ensure that individuals have sufficient income to meet their needs.

Opportunities

- Increasing labor force participation: Reforming the state pension age can help to increase labor force participation, as individuals are able to work for longer. This can boost economic growth and reduce the burden on government finances.

- Reducing the burden on government finances: Reforming the state pension age can help to reduce the burden on government finances, as the government will have to pay out less in pension benefits.

Communicating State Pension Age Changes

Effective communication is crucial for informing the public about state pension age changes. It helps individuals understand their retirement options, plan accordingly, and make informed decisions about their financial future.

Various methods are used to communicate state pension age changes, including:

Government Websites and Publications

- Official government websites provide detailed information on state pension age changes, eligibility criteria, and how to apply for benefits.

- Government publications, such as leaflets and brochures, offer concise and accessible summaries of the changes.

Media Outreach

- Press releases, media briefings, and interviews with government officials help disseminate information to the public through newspapers, television, and radio.

- Social media platforms allow for targeted communication and engagement with specific audience groups.

Community Engagement

- Public meetings, town hall events, and workshops provide opportunities for direct interaction between government representatives and the public.

- Community outreach programs engage with vulnerable or marginalized groups who may not have access to traditional communication channels.

Challenges and Best Practices

Communicating complex policy changes like state pension age adjustments presents challenges. These include:

- Ensuring clarity and accessibility of information for diverse audiences.

- Addressing misinformation and providing accurate and timely updates.

- Engaging with stakeholders and considering their perspectives.

Best practices include:

- Using plain language and avoiding technical jargon.

- Providing multiple communication channels to reach different audiences.

- Involving stakeholders in the communication process.

- Evaluating the effectiveness of communication efforts and making adjustments as needed.

Research and Data on State Pension Age

State pension age is a complex and controversial topic, with a wide range of research and data available on the subject. This research can be divided into three main categories: academic papers, government reports, and international comparisons.

Academic Papers

Academic papers on state pension age typically focus on the economic and social implications of raising or lowering the pension age. These studies often use sophisticated econometric models to estimate the impact of pension reforms on factors such as employment, wages, and government spending.

One of the most important findings of academic research on state pension age is that raising the pension age can have a significant impact on the labor market. For example, a study by the National Bureau of Economic Research found that raising the pension age in the United States by one year would increase the labor force participation rate of older workers by 2.5%.

Another important finding of academic research is that raising the pension age can have a positive impact on government finances. For example, a study by the International Monetary Fund found that raising the pension age in Europe by five years would reduce government spending on pensions by 10%.

Government Reports

Government reports on state pension age typically provide a more policy-oriented perspective than academic papers. These reports often make recommendations for how to reform the pension system, based on the latest research and data.

One of the most important government reports on state pension age is the report of the Social Security Advisory Board. This report provides a comprehensive overview of the state of the Social Security system and makes recommendations for how to reform the system.

Another important government report on state pension age is the report of the Congressional Budget Office. This report provides an analysis of the economic and fiscal impact of different pension reform proposals.

International Comparisons

International comparisons of state pension age can provide valuable insights into the different approaches that countries have taken to reforming their pension systems. These comparisons can help to identify the best practices and avoid the pitfalls of pension reform.

One of the most important findings of international comparisons of state pension age is that there is a wide range of variation in the pension age across countries. For example, the pension age in the United States is 66, while the pension age in France is 62.

Another important finding of international comparisons is that there is no one-size-fits-all approach to pension reform. The best approach to pension reform will vary depending on the specific circumstances of each country.

Limitations and Biases

It is important to note that there are some limitations and biases in the existing research on state pension age. For example, many studies are based on small sample sizes, which can make it difficult to generalize the results to the wider population. Additionally, many studies are funded by special interest groups, which can bias the results in favor of a particular policy outcome.

Need for Further Research

Despite the limitations of the existing research, there is still a need for further research on state pension age. This research should focus on the following areas:

– The impact of demographic changes on state pension age

– The impact of economic conditions on state pension age

– The impact of social policy on state pension age

– The best practices for pension reform

Key Findings and Implications

The key findings of the existing research on state pension age are as follows:

– Raising the pension age can have a significant impact on the labor market.

– Raising the pension age can have a positive impact on government finances.

– There is a wide range of variation in the pension age across countries.

– There is no one-size-fits-all approach to pension reform.

The implications of these findings are that policymakers should carefully consider the economic and social impact of raising the pension age before making any changes to the pension system. Policymakers should also consider the experiences of other countries when reforming their own pension systems.

Report on Research Findings and Recommendations

The following is a concise report that presents the research findings and recommendations for future research on state pension age:

Research Findings

– Raising the pension age can have a significant impact on the labor market.

– Raising the pension age can have a positive impact on government finances.

– There is a wide range of variation in the pension age across countries.

– There is no one-size-fits-all approach to pension reform.

Recommendations for Future Research

– The impact of demographic changes on state pension age

– The impact of economic conditions on state pension age

– The impact of social policy on state pension age

– The best practices for pension reform

Case Studies of State Pension Age Reforms

Analyzing case studies of successful and unsuccessful state pension age reforms in different countries can provide valuable lessons and insights for future reforms. By examining the factors that contributed to success or failure, policymakers can identify best practices and avoid potential pitfalls.

One notable success story is the gradual increase in the state pension age in Denmark. The reform, which began in 1998, involved raising the pension age by one month each year until it reached 67 in 2022. This gradual approach allowed individuals and employers to adjust to the change over time, minimizing disruption and ensuring a smooth transition.

Lessons Learned

- Phased implementation: Gradual changes allow for adaptation and reduce the impact on individuals and employers.

- Communication and transparency: Clear and timely communication is crucial to inform stakeholders about the changes and address concerns.

- Flexibility and adaptability: Reforms should consider individual circumstances and allow for adjustments based on changing demographics and economic conditions.

Implications for Future Reforms

- Policymakers should consider phased implementation to minimize disruption and allow for adjustment.

- Effective communication strategies are essential to ensure understanding and acceptance of reforms.

- Reforms should be designed to accommodate changing demographics and economic conditions, allowing for flexibility and adaptability.

Ethical Considerations in Setting State Pension Age

Ethical considerations play a pivotal role in determining the appropriate age for state pension eligibility. The key principles guiding these considerations include fairness, equity, and intergenerational solidarity.

Fairness dictates that individuals who have contributed to the pension system throughout their working lives should receive a reasonable pension in retirement. Equity ensures that individuals in similar circumstances receive comparable pension benefits, regardless of their gender, race, or other characteristics. Intergenerational solidarity emphasizes the responsibility of younger generations to support the well-being of older generations, particularly during retirement.

Ethical Dilemmas

Setting the state pension age involves several potential ethical dilemmas:

- Balancing the interests of current pensioners with those of future generations.

- Ensuring that the pension system is sustainable in the long term while providing adequate benefits to retirees.

- Addressing the impact of pension age changes on individuals’ retirement plans and financial security.

Future Trends in State Pension Age

The future of state pension age is uncertain, as it is influenced by a number of factors, including the impact of technology and automation on retirement. In the coming decades, state pension systems will face a number of challenges and opportunities, including:

Technological advancements

Technology and automation are rapidly changing the nature of work, and this is likely to have a significant impact on retirement. As more and more jobs are automated, people may be able to retire earlier, as they will no longer be needed in the workforce. However, this could also lead to a decrease in the number of people paying into the state pension system, which could make it difficult to fund.

Increasing life expectancy

People are living longer than ever before, and this is putting a strain on state pension systems. As people live longer, they will need to draw on their pensions for a longer period of time, which could lead to the depletion of funds.

Changing demographics

The demographics of the population are also changing, with the number of older people increasing and the number of younger people decreasing. This could lead to a situation where there are not enough working people to support the growing number of retirees.

These are just some of the challenges and opportunities that state pension systems will face in the coming decades. It is important to start planning for the future now, in order to ensure that the system is sustainable and can continue to provide support for retirees.

Potential future of state pension age

The future of state pension age is uncertain, but there are a number of possible scenarios. One possibility is that the state pension age will continue to increase, as it has done in recent years. This would help to ensure the sustainability of the system, but it would also mean that people would have to work for longer before they could retire.

Another possibility is that the state pension age will be linked to life expectancy. This would mean that the state pension age would increase as people live longer. This would help to ensure that people would receive a pension for a reasonable period of time, but it could also lead to a situation where people would have to work for a very long time before they could retire.

A third possibility is that the state pension system will be reformed altogether. This could involve introducing a new system, such as a citizen’s pension, or it could involve changing the way that the current system is funded.

It is too early to say which of these scenarios is most likely to happen. However, it is important to start thinking about the future of state pension age now, in order to ensure that the system is sustainable and can continue to provide support for retirees.

Glossary of Terms Related to State Pension Age

This glossary provides clear and concise definitions of key terms related to state pension age. It is organized alphabetically for easy reference.

Actuarial Deficit

An actuarial deficit occurs when the present value of expected future pension payments exceeds the present value of expected future contributions and investment earnings.

Dependency Ratio

The dependency ratio is the ratio of the number of people receiving pensions to the number of people working and paying into the pension system.

Retirement Age

Retirement age is the age at which an individual becomes eligible to receive a state pension.

Last Recap

The intricacies of state pension age require a nuanced understanding of the interplay between demographic, economic, and social factors. As we navigate the challenges and opportunities presented by an aging population, it is imperative that we engage in informed discussions and develop sustainable policies that ensure the well-being of individuals and the stability of our pension systems.

FAQ Guide

What is the rationale behind setting a state pension age?

State pension age is primarily determined by the need to balance the sustainability of pension systems with the well-being of individuals. It aims to ensure that there are sufficient funds available to support the growing number of retirees while also providing individuals with a reasonable period of retirement.

How does state pension age impact individuals?

State pension age has significant implications for individuals’ retirement planning and financial security. It affects the age at which they can access state pension benefits, which in turn influences their retirement savings and overall financial well-being.

What are the key factors that influence state pension age decisions?

A multitude of factors influence state pension age decisions, including demographic changes, economic conditions, labor market trends, and social norms. Increasing life expectancy, rising healthcare costs, and the sustainability of pension systems are among the most prominent considerations.